📊 Daraz Group Financial Snapshot || Daraz Loss 2025

📊 Daraz Group Financial Snapshot

-

Fiscal Year ending March 2023-24-25:

-

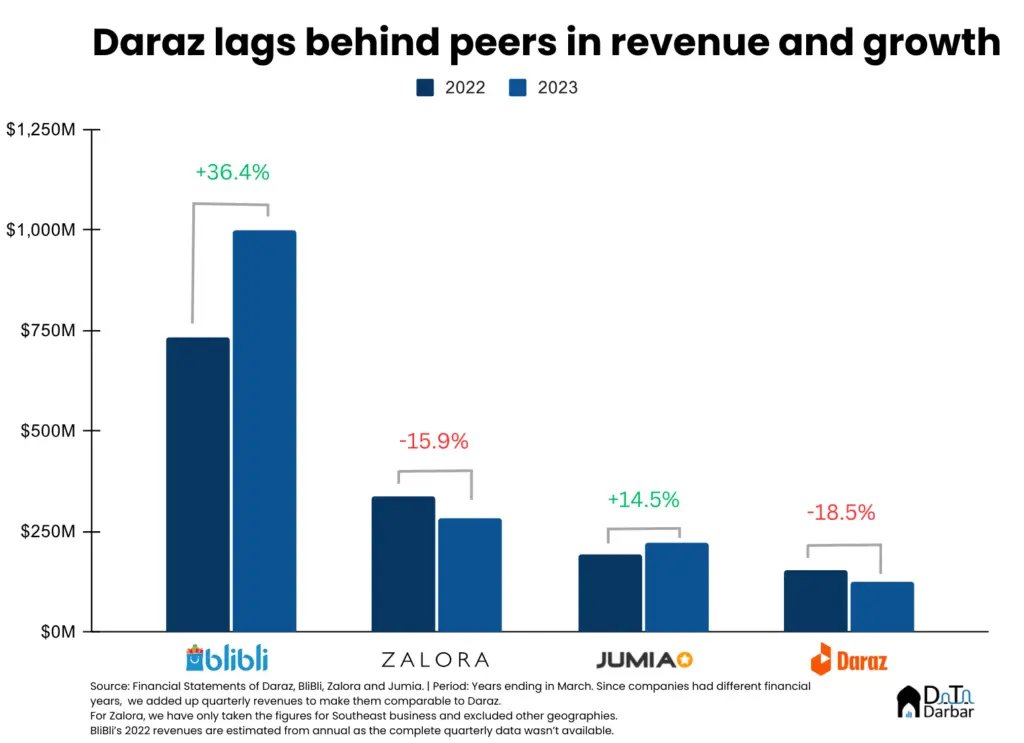

Total revenue: US $125.5 million, down from US $153.9 M the year before.

-

Operating loss (after tax): between US $144 M and $160.9 M—depending on accounting treatment LinkedIn+2Insights by Data Darbar+2The Company Check+2.

-

Net margin stood at roughly –115% to –128% Insights by Data Darbar.

-

-

Current estimates (Summer 2025) suggest Daraz now generates around US $750 million in annual revenue LeadIQ.

💰 What This Means for “Earnings”

-

As a company under Alibaba, Daraz’s financials are consolidated and aren’t broken out separately in parent company filings.

-

That means any profit distributions or compensations to owners/executives are not individually disclosed publicly.

-

Especially with the significant losses reported in FY 2023, it’s likely that executive compensation is modest relative to revenues—or tied to Alibaba’s broader performance.

✅ Summary

| Aspect | Value |

|---|---|

| Personal earnings of owner | Not publicly disclosed |

| Company Revenue (FY 2023) | ~US $125.5 million |

| Operating Loss (FY 2023) | ~US $144–160.9 million (net margin –115% to –128%) |

| Latest Estimated Revenue (2025) | ~US $750 million annual revenue reported in public business summaries |

ℹ️ Additional Notes

-

If you’re asking because you’re curious about the founder’s net worth—early investors or founders like Bjarke Mikkelsen may have some equity stakes, but no verified individual net worth for them is published.

-

Daraz’s business has pivoted significantly since its acquisition by Alibaba, including management changes and restructuring, making individual owner payouts opaque.

Let me know if you’re also interested in Alibaba Group’s earnings, executive compensation practices, or comparable e‑commerce valuations!

July 29, 2025, 06:35 am